Incoterms® (International Commercial Terms) are a universal set of internationally recognised trade terms published by the International Chamber of Commerce (ICC).

Incoterms® are used in international sales contracts to clearly define the respecting obligations of the seller (exporter) and the buyer (Importer)

These terms provide a common framework for managing key components of cross-border trade transactions, including:

- The allocation of responsibilities for the delivery and handling of goods.

- The distribution of costs related to transportation, insurance, customs duties, and other associated charges

- The precise point at which risk for loss or damage to the goods transfers from the seller to the buyer

- The obligations of each party concerning export and import documentation, customs clearance, and regulatory compliance

By incorporating Incoterms® into a sales or export contract, parties achieve greater legal certainty regarding their roles and liabilities. This clarity helps minimize misunderstandings, reduce commercial risk, and prevent disputes in international trade.

Incoterms® themselves are not Laws but stating the terms in your sales/export contract is a legal document.

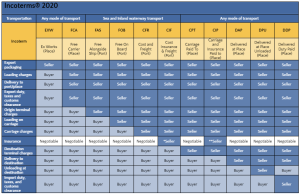

There are 11 types of Incoterms® which outline the responsibilities of the buyers and sellers as per above table and below definitions.

EXW - Ex Works:

FCA - Free Carrier:

FAS - Free Alongside Ship:

FOB - Free on Board:

CFR - Cost and Freight:

CIF - Cost, Insurance, and Freight:

CPT - Carriage Paid To:

CIP - Carriage and Insurance Paid To:

DAP - Delivered at Place:

DPU - Delivered at Place Unloaded:

DDP - Delivered Duty Paid:

*CIF requires at least an insurance with the minimum cover of the Institute Cargo Clause (C) (Number of listed risks, subject to itemised exclusions)

**CIP requires at least an insurance with the minimum cover of the Institute Cargo Clause (A) (All risk, subject to itemised exclusions)